Interest Rates

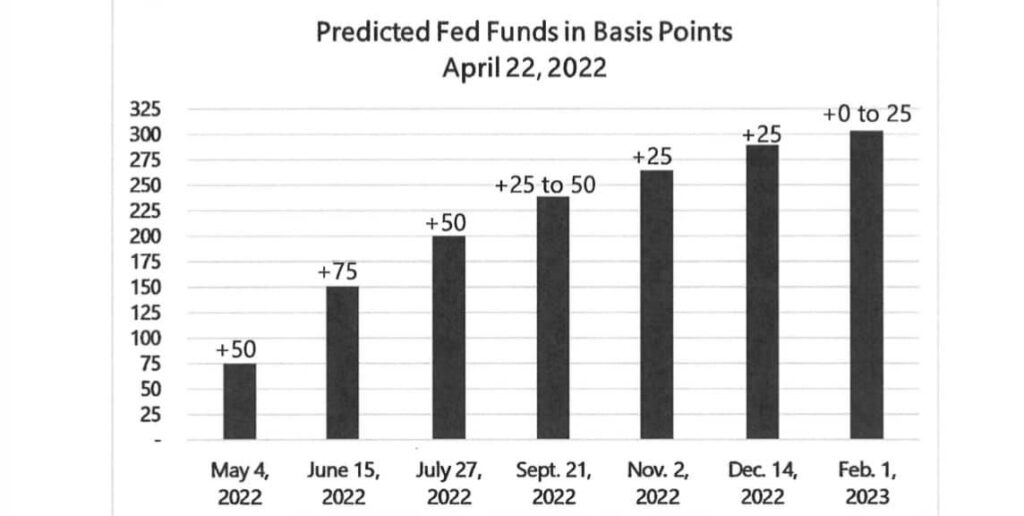

Interest Rates have continued to climb since January 1, 2022. This chart shows the probability weighted forecast for Fed Funds by Fed meeting date as tracked by the Chicago Mercantile Exchange’s Fed Watch Tool.

The Chicago Mercantile Exchange’s (CME) FedWatch Tool examines the likelihood of FOMC (Federal Open Market Committee) rate changes for future meetings. The tool uses 30-Day Fed Fund futures pricing statistics, this data has been used for decades to ascertain the market’s temperment concerning the probability of adjustments to the monetary policy of the U.S.

The CME FedWatch Tool envisions both contemporary as well as past likelihoods of different FOMC rate change results for any specific meeting date. In addition, the Fedwatch tool also exhibits the “Dot Plot” of the Fed, which displays FOMC members’ estimates for the target rate of the Fed and the rate’s changes over time.

Your credit score has always been important but it’s more important now than ever before. If you have a 739 credit score, a borrower with a 740 will get a better deal on interest rates/fees. Teach your kids that their credit score is how a bank views their character and how responsible that they are. If you have a credit card or credit line. Don’t ever charge more than 70% of that credit line.

I personally don’t believe in credit card debt, it’s a trap in my opinion. I do understand that many Americans need to have it in certain times. Credit cards are great if you use them responsibly and pay them off each month. You can earn points or rewards as well as raise your credit score with credit cards. Higher rates are absolutely coming. Congratulations to everyone who has below a 3% interest rate on your mortgage. In 25 years I’d never witnessed rates like we had in 2020 and 2021 at below 3%. I don’t think we will ever see that again. Have a great day friends!

Sincerely,

Neal Bailes

Recent Posts

Categories

Address

Real Estate Finance Group (REFG)

4707 Papermill Dr

Suite 102

Knoxville, TN 37909

Connect

Phone: 865-584-1584

Fax: 865-584-1484

Recent Comments